4 Steps to Creating a Financial Budget

A budget can be used to help you feel more in control of your finances, make it easier to track your spending and help you save for your financial goals. The following steps will help you create a financial budget.

Step 1: Identify your income and expenses

Your first step in creating a financial budget is to calculate your household’s net income, which is the earnings deposited into your family members’ accounts after taxes and deductions. You then need to factor in all your monthly expenses. These could include, but are not limited to:

- Insurance costs

- Utility bills

- Groceries and food

- Transportation

- Housing or rent

- Childcare or school fees

- Miscellaneous purchases (entertainment, shopping, home décor, gifts, etc.)

A good rule of thumb is to treat any regular contributions you make to your investment accounts as another type of expense.

Step 2: Distinguish your wants from your needs

Many people, when they begin tracking their expenses, realize that they often buy things they don’t need – many of these purchases being impulsive buys.

Have you ever had a conversation with someone about pizza, and rather than going home and making dinner with the groceries you bought earlier that week, you pick up pizza on your way home? Or you buy that nice shirt you saw in the store that ends up sitting in your closet for months with the tag still attached?

The key to making a useful budget and having good money management is to determine what you want versus what you need. For a regular planned shopping trip, create a list of the things you are going to buy and stick to it when you go out. For other items you find yourself “needing” in the moment, hold off and see if you can get by without them. If three or four weeks later, you still find yourself needing one of the items, it can be considered a justifiable purchase.

Step 3: Create your budgeting plan

The word “budget” often perceived as a negative term – alluding to restriction and deprivation of money. However, it is just another word for how you plan on spending and saving your money. Your budget will allow you to be free from financial stress and help you grow your wealth.

When creating your budget, start out by writing down what your net income is. Then, write out what your anticipated monthly expenses are (your needs, not your wants) with a rough estimate of what they cost. Subtract your expenses from your income and divide the remainder between your “wants”, savings and investment contributions. During this step, it is key that you ensure you are not overspending and exceeding your income level.

It is also important to factor in your seasonal expenses. During holiday seasons you may find yourself spending more money and many want to consider saving extra the months leading up to or following that time. Do you receive a yearly bonus from you job at the beginning of the year? That may be a time when it would make sense to contribute more money to your savings or make a bigger purchase you have been holding off on.

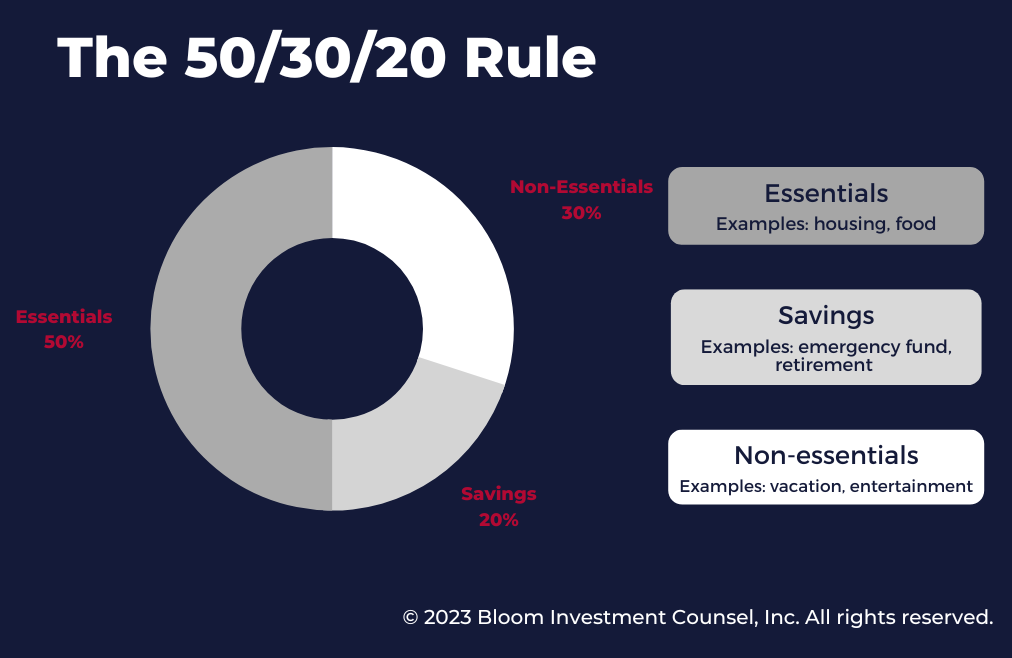

How much should you spend and how much should you save? The 50/30/20 rule:

While there is no set amount of how much you should spend or save, U.S. Senator Elizabeth Warren discusses the “50/30/20 budgeting rule” in her book, All Your Worth: The Ultimate Lifetime Money Plan. The idea is that you divide your net income across three spending categories:

- Essential items: This includes purchases that you need, such as housing expenses, food, insurance, bills, etc.

- Non-essential items: This includes purchases that you want or desire, such as vacations, entertainment, designer items, etc.

- Savings: This includes your contributions to your savings accounts, investments, or a retirement fund.

While this “rule” may be a perfect way of allocating money for some people, it is just a guide to encourage focusing your net income on essential items and savings. The way you put this philosophy into action depends on your income level, how much debt you have, your employment type, your stage in life and what your financial goals are.

Step 4: Put your plan into action

Now that you have your budgeting plan, it is time to put it into action. The best way to ensure your plan is executed properly is to make sure that everyone involved is aware of the details of the plan. If you have a spouse or children who contribute to your household income and/or expenses, confirm they are aware of the allocation of finances: how much is for essentials, non-essentials, and savings.

At the end of each month, total your income minus your expenses to double check that you are not short any money. If you are short, look over your expenses to see which you can cut to make sure your essential purchases can be completed. Any left-over money you have at the end of the month should be an extra contribution to your savings.

Connect with us on LinkedIn to stay up to date on resources on protecting, preserving, and building wealth.

This content is provided for general informational purposes only and does not constitute financial, investment, tax, legal or accounting advice nor does it constitute an offer or solicitation to buy or sell any securities referred to. Individual circumstances and current events are critical to sound investment planning; anyone wishing to act on this content should consult with his or her financial partner or advisor.