How a Positive Money Mindset Can Help You Achieve Your Financial Goals

Your money mindset is the prevailing attitude that you have towards your finances. It governs how you make key financial decisions every day and has a big impact on your ability to achieve your financial goals. Ensuring you have a positive money mindset will allow you to have a better chance of reaching your financial goals.

What is a “Money Mindset”

A money mindset is your unique set of beliefs and attitudes towards money. It drives your decision-making regarding saving, spending, and sharing money, as well as how you handle debt, your investment choices, your perspective on how much money is worth and your overall ability to grow wealth.

Your mindset towards money is often developed very early on in life and typically derives from your parents’ or guardians’ relationship with money and their beliefs. These influences, along with other life experiences, consciously or unconsciously shape your unique set of values and beliefs around money.

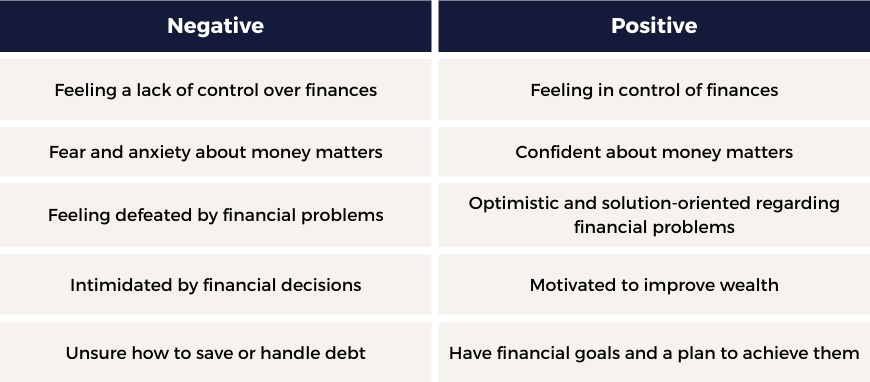

Characteristics of a Negative and Positive Money Mindset

Now, you may be thinking, “what type of mindset towards money do I have – is it negative or positive?”. There are some key characteristics that can help you determine which money mindset you currently have:

If you find yourself residing with more of the negative characteristics, not to worry. Master your money mindset and learn how to go from a negative mindset to a positive one in the next section.

How to Achieve a Positive Money Mindset

Understand your current perspective

The first step in achieving a positive money mindset is to understand what your current perspective is. Ask yourself these questions, and think about how they may impact your decision making around money:

- How was your family’s relationship with money when you were young?

- What messages about money were you taught at a young age?

- How did you approach your finances as you entered adulthood?

Thinking about your past experiences will help you to be aware of how your current mindset towards money has been influenced.

Don’t dwell on past financial hardships

Your past experiences have shaped who you are today, and you can’t change what has already happened – but you are able to make improvements now for your future self. Learn from your past mistakes and use those experiences to aid in your success.

Monitor your spending

The next step in achieving a positive money mindset is to analyze your financial habits and begin to monitor your spending. Recognize what you spend your money on – do you really need to make those purchases? How do you feel when you spend your money – does it bring you stress or anxiety? What triggers you to over or under spend?

Stay committed to changing your money habits

To be committed to changing your current money habits, set yourself attainable short-term and long-term goals, with a plan for how you can achieve them. Some ways you can commit to changing your habits include:

- Create a financial planner to keep you within your budget

- Pay off your higher interest rate debts first

- Create and contribute to an investment savings account

- Consult with financial professionals

Have a positive outlook on your progression moving forward

The final step in achieving a positive money mindset is to not doubt yourself along the way. Paying off small amounts of debt or contributing to your savings, RRSP or TFSA, is a step in the right direction – a small win puts you closer to your end goal. There will be times along the way where you may have an emergency expense, or splurge on a purchase, but don’t let that discourage you from moving forward. Celebrate every win, work through every hardship, and acknowledge and be proud of the progress you make.

The Impact of Your Money Mindset on Your Financial Goals

Now that you know what a positive money mindset is and how to achieve one, how will this mindset help you reach your financial goals? It’s quite simple: having a positive mindset towards your finances will allow for you to have more confidence, freedom and motivation. You will make smarter, more calculated decisions, you will be more likely to make investments and contribute to your savings, and you will be able to overcome any hardships or pitfalls that come your way.

Investing with Bloom Investment Counsel, Inc.

Now that you have a positive money mindset, are you looking to build long-term wealth?

Since our inception in 1985, we at Bloom Investment Counsel, Inc. have provided actively managed, customized Canadian and U.S. dividend-paying portfolios for wealthy individuals, family offices, foundations, corporations, institutions and trusts.

Get in touch with us today. Call us at +1-416-861-9941 or email us at info@bloominvestmentcounsel.com. You can also connect with us on LinkedIn to stay up to date on resources on protecting, preserving, and building wealth.

Get access to our exclusive Bloom Investment Overview by subscribing here.

This content is provided for general informational purposes only and does not constitute financial, investment, tax, legal or accounting advice nor does it constitute an offer or solicitation to buy or sell any securities referred to. Individual circumstances and current events are critical to sound investment planning; anyone wishing to act on this content should consult with his or her financial partner or advisor.