The Ultimate Guide to Dividend Investing

Dividend investing can be a great investment strategy to generate a regular stream of income. You can lean on income from dividend-paying stocks to fund your retirement without touching your capital (initial investment).

But if you wait until your retirement to start investing in dividend-paying stocks, you’ll miss the opportunity to reinvest your dividend income today (if cash flow is not desired) to compound your returns for even greater future income that can be used to create generational wealth and fund philanthropic ambitions.

Learn all about dividend investing in this ultimate guide… today!

This guide is written by Bloom Investment Counsel, Inc., a professional investment manager who has been actively managing customized Canadian and U.S. dividend-paying portfolios since 1985.

This one-stop guide provides answers to all investors on the following questions:

- Why invest in dividend-paying stocks?

- Is a high dividend yield always a good thing?

- Are dividend-paying stocks always stable?

- How can a dividend-paying portfolio benefit me?

Why Invest in Dividend-Paying Stocks?

1. Dividend Investing is a Total Return Approach to Investing

Dividends often comprise a large and more stable part of the total return of a company’s stock.

Dividend-paying stocks have two components to their total return:

- The regular dividend payment; and

- The price appreciation of the underlying stock.

Even if the share price of the stock declines you still collect the dividend. Investing in dividend-paying stocks is like getting paid to wait for the underlying stock to grow and increase in value, giving you short-term and long-term reward.

2. Dividend Investing Can Help You Stay Ahead in a Lower Interest Rate and/or Inflationary Environment

In a lower interest rate environment, interest payments on fixed income investments such as GICs are often insufficient to keep pace with the rate of inflation given that these payments are fixed and do not increase with inflation. Dividends, on the other hand, can and often are, increased based on inflation affected earnings. Investing in dividend paying stocks can therefore help you stay ahead.

3. Dividend Investing Can Help You Preserve Capital in Times of Market Volatility

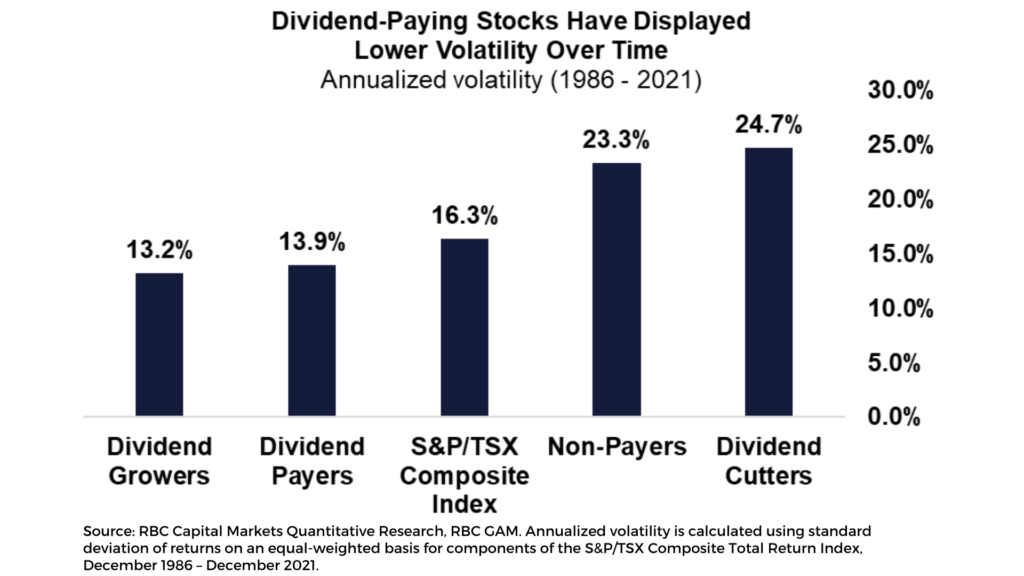

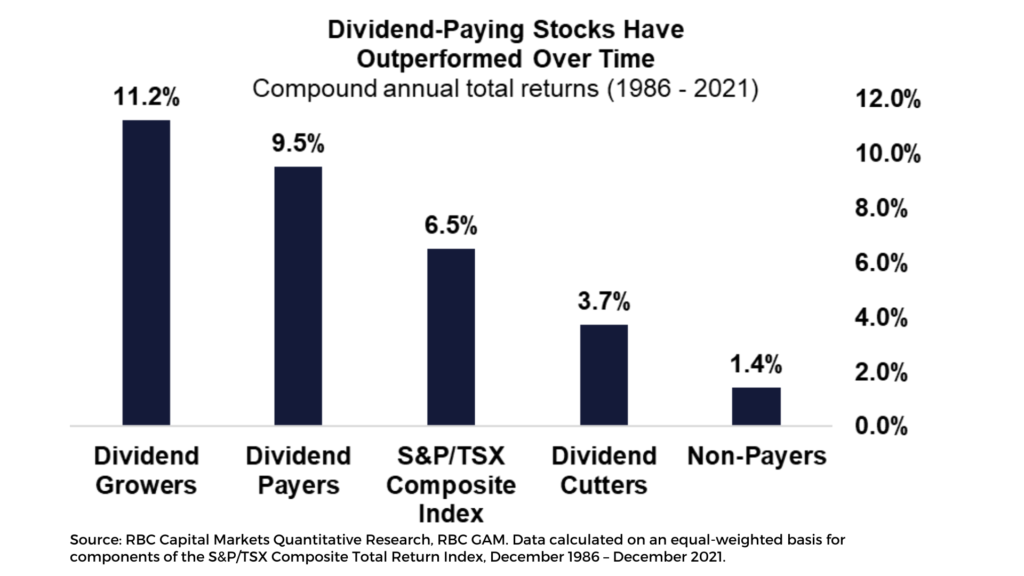

Investing in a well-diversified portfolio of dividend-paying stocks is a proven strategy to preserve wealth in turbulent markets. Historical evidence suggests that dividend-paying stocks, as an asset class, not only tend to be less volatile than the overall market but also outperform the broader market over many decades.

Volatility in stock markets can make it difficult for investors to preserve their capital while attaining a reasonable level of income. Dividend-paying stocks can provide this income. Dividends provide a nice cushion against stock price declines in volatile markets, effectively providing a backstop for the investor while they remain fully invested to benefit from rebounds and recovery.

There can also be instances when management initiates or increases dividends to assure investors that, despite the current share price, the company has a solid financial position combined with opportunities for growth.

4. Paying Dividends Imposes Discipline on Corporate Management Teams

Companies that pay dividends need to set aside cash for this purpose. This requires management to be disciplined in their deployment of free cash flow as significant amounts are already dedicated to dividends. Consistent dividend payments provide evidence of a company’s strength and of positive future expectations for earnings growth.

5. Dividend Investing Has Benefits for Canadian Taxable Investors

Eligible dividends earned by Canadian taxable investors are treated favorably for tax purposes by the Canada Revenue Agency, thereby contributing positively to the after-tax rate of return.

Is a High Dividend Yield Always a Good Thing?

The biggest misconception in dividend investing is the idea that investors must simply select a collection of dividend-paying stocks with the highest yields. However, investors must be careful not to focus on one metric only. Remember, dividend investing has two components of return and new dividend investors should not be distracted by the current yield alone when the goal is to preserve and build long term wealth.

Additionally, there exist what are referred to as “dividend traps” which occurs when investors are lured in by a high dividend yield, only to find out that the underlying company was using it to attract new investors and that it was not a great purchase. In these cases, the management team often does not know how to grow the business other than giving money away to attract new shareholders. It is always important to confirm that the underlying company’s fundamentals fall into line.

For long-term dividend investors, especially those seeking a reliable stream of income, investing in a company that pays sustainable dividends is more important than investing in a company that pays a high-dividend yield that may not be sustainable. Depending on the level of income that you are striving for, it may make sense to invest in companies who have a lower yield, but are dividend growers, which may result in a more profitable long-term investment overall.

Are Dividend-Paying Stocks Always Stable?

There is no such thing as a risk-free investment—including dividend-paying stocks. However, over the long-term, consistent dividend-payers have realized higher returns with less risk than non-dividend paying stocks. As mentioned above, historical evidence suggests that dividend-paying stocks not only tend to be less volatile than the overall stock market but have also outperformed the broader market over many decades.

Dividend-paying stocks from financially sound companies that can pay and even increase their dividends over a long period (through all phases of a market cycle) are often considered more reliable investments that can provide dividend investors consistent income for the long term.

How Can a Dividend-Paying Portfolio Benefit Me?

Dividend-Paying Portfolios for All Investors

A well-diversified portfolio of dividend-paying stocks can help you preserve and build wealth through all phases of the market cycle, allowing you to sleep better at night knowing that you can keep your taxes low (for Canadian taxable investors), your emotions in check during volatile markets, that you have a potential hedge against inflation for your hard-earned money, and the best of all, that you will receive a reliable stream of (possibly growing or “inflation-adjusted”) income from…. doing absolutely nothing.

If an additional income stream is not necessary, a professional, private and personal dividend portfolio manager, such as Bloom Investment Counsel, Inc., can reinvest the dividend income with the long term goal of the portfolio continuing to grow through long-term capital appreciation of the underlying stocks and compounding, for greater future income or wealth.

Dividend-Paying Portfolios for Canadian Endowments, Foundations, Corporations, Institutions or Trusts

The additional reliable, independent income from dividend payouts means a more tax-efficient strategy of investing your capital because dividends are taxed at a lower tax rate. Dividend income from the portfolio can also be used to fulfill a foundation’s mandatory disbursement requirement without the need to withdraw from your principal.

Dividend-Paying Portfolios for Philanthropy

A dividend-paying portfolio can help you create an enduring philanthropic legacy by providing dividend income that can be used for donations to a charitable cause. With this approach, control of the initial investment into the portfolio (the capital) is retained and as time goes by, not only will this capital hopefully grow, but the portfolio will also generate more income for donations because dividends can be, and often are, increased over time.

Your Personal Canadian and U.S. Dividend-Paying Portfolio with Bloom Investment Counsel, Inc.

Do you dream of having your own private professional investment manager to create and actively manage your personal Canadian and U.S. dividend-paying portfolio so you can sit back and relax while you watch your regular stream of dividend income come in and your wealth grow over the long term (while helping to protect against inflation)? Bloom Investment Counsel, Inc. can help make that dream a reality.

Bloom Investment Counsel, Inc. has nearly four decades of experience investing in dividend-paying stocks. We provide actively managed, personalized Canadian and U.S. dividend-paying portfolios to help wealthy individuals, family offices, foundations, corporations, institutions, and trusts.

With our personalized dividend-paying portfolios, our clients’ portfolios earn a reliable stream of income which can be reinvested or withdrawn, in addition to participating in potential capital appreciation from increase in value of the underlying stocks themselves.

For new account inquiries, we would be pleased to discuss our capabilities with you directly or provide additional information. Please email info@bloominvestmentcounsel.com to speak to a senior member of our team.

Follow Bloom Investment Counsel, Inc. on LinkedIn to stay up to date on our most recent articles.

This content is provided for general informational purposes only and does not constitute financial, investment, tax, legal or accounting advice nor does it constitute an offer or solicitation to buy or sell any securities referred to. Individual circumstances and current events are critical to sound investment planning; anyone wishing to act on this content should consult with his or her financial partner or advisor.