How To Create Steady Cash Flow For Financial Independence In Retirement And Beyond

Between managing expenses, keeping tabs on income, and being mindful of liquidity, our retirement years can feel like a complex juggling act. Read this article to understand how to preserve and sustain a desirable cash flow in your golden years through calculating what you keep based on current tax legislation, and how you can start improving your cash flow so that you can start experiencing the freedoms that come with financial independence.

Further, we will show you how Bloom Investment Counsel takes a different route with our valued private clients—an ‘income first’ approach, with our investment philosophy rooted in ensuring our clients receive a flow of cash in the form of dividends—because when you have the confidence that comes from a steady cash flow, the possibilities become endless.

Navigating Cash Flow During Retirement

The ways in which you generate income during retirement will change. It is important to provide cash flow alternatives to cover everyday expenses, discretionary spending, and the lifestyle to which one has become accustomed. These expenses will hinge greatly on your lifestyle and health, and will likely fluctuate over the ensuing years of retirement.

Retirement cash flow or income will also vary significantly based on how much capital has been saved ahead of retirement to fund the retirement, and the execution of a successful long-term investment plan for the capital that has been saved. Important considerations for this phase of life include not only planning how to create a steady stream of income, but also weighing the tax rates for different types of income, and navigating and planning for the effects of inflation on your assets.

This section will guide you through how to navigate these complex considerations in a simple, user-friendly manner.

How Do You Create A Retirement Cash Flow?

- Try investing in dividend paying equities, which provide a steady stream of income and are taxed at a more favorable rate given the dividend tax credit.

- Another way to create cash flow in retirement is to invest in fixed income instruments such as bonds, which, depending on the length of investment, provide a pre-determined amount of income upon maturity. This income, however, is not as tax efficient as dividend income as it is taxed at the client’s highest marginal tax bracket.

What Is Inflation?

- Inflation occurs when, on average, prices begin to rise in an economy, meaning an individual’s money does not stretch as far as it once did when prices were lower.

- While the rate fluctuates year over year, the current average inflation is estimated at 1 to 3 percent per year in Canada.

How Does Inflation Affect Cash Flow?

- It is important to carefully craft an investment plan that takes into account an increase in expenses due to inflationary pressures and a stream of income that will also grow with inflation.

- Basing your investment plan solely on long-term interest bearing investments or preferred shares, which do not compensate for a rising inflationary environment, can be substantially damaging to your long-term retirement goals.

- In an inflationary environment, some companies will see an increase in their revenues as a result of charging higher prices for their goods or services. In these situations, a company may choose to increase their dividends—thereby providing you with a higher stream of income.

It’s important to note that if your interest or dividend income is fixed, but due to inflation your expenses are gradually rising, this can cause your retirement plan to become strained.

How Do You Manage Cash Flow with Inflation?

A sound retirement investment plan needs to contain a mechanism that will positively adjust the amount of income that is generated for the plan as inflationary pressures cause expenses to rise. Here are a few asset management tactics to ensure your money does not fall victim to the effects of inflation:

- Dividend Paying Common Stocks: These stocks pay either monthly or quarterly dividends which tend to rise over time as inflation increases your underlying investments’ profit. Stocks that annually increase their dividends, called “dividend growth stocks”, are especially attractive for combating the negative effects of inflation.

- Real Estate Investment Trusts (REITs): These investments should also be considered, as they normally pay monthly distributions that are closely aligned to the net returns achieved from their underlining real estate investments, thereby keeping up with inflation.

- Real Estate: To counteract the consequences of inflation on your cash flow, if your finances permit, try investing in real estate, as rental income received by the investor will normally rise over a period of time with inflation.

- Look for Capital Growth: Fixed income investments such as bonds and preferred shares can, with the right interest rate environment, provide capital growth during periods of inflation.

How Much Tax Will You Pay On Your Investments?

At Bloom Investment Counsel, we believe that ‘it’s not what you have—it’s what you keep. The fundamental principle is having tax efficient income so that you have more in your pocket. Here are a few key points to note when it comes to navigating taxable income during retirement:

- Income from annual RRIF distributions bear tax at the highest rate applicable to you.

- Interest income, while usually more assured, is also taxed at the highest rate applicable to you.

- Dividend income is taxed at lower rates and helps to deliver cash flow, whether an investor reinvests this income or withdraws this income on a regular basis for lifestyle needs.

- REITs have some tax advantages.

- Capital gains are taxed at the lowest rate.

What are the Federal and Ontario Tax Brackets and Rates in 2021?

Currently, Federal income tax is calculated as follows:

- On the first $49,020 of taxable income: 15%, plus

- On taxable income between $49,020 and $98,040: 20.5%, plus

- On taxable income between $98,040 and $151,978: 26%, plus

- On taxable income between $151,978 and $216,411: 29%, plus

- On taxable income over $216,411: 33%

Ontario income tax is currently calculated as follows:

- On the first $45,142 of taxable income: 5.05%, plus

- On taxable income between $45,142 and $90,287: 9.15%, plus

- On taxable income between $90,287 and $150,000: 11.16%, plus

- On taxable income between $150,000 and $220,000: 12.16%, plus

- On taxable income over $220,000: 13.16%

There are also surtaxes on Ontario taxes over certain amounts, which increase Ontario tax payable.

How Can You Calculate How Much Tax You Will Pay on Your Investments & the Net Return?

- To calculate your estimated income tax, reference a free online income tax calculator, such as one from Intuit’s TurboTax.

- To calculate the potential return on your investments, reference a free online investment calculator, such as Calculator.net or the Bank of Canada’s investment calculator.

Tax Examples

- Example #1: Interest Income vs. Dividend Income

- Interest Income: Taking a real world example, in Ontario in 2021, for someone who has $100,000 in taxable income, interest income would net a return of 56.6% after tax.

- Dividend Income: For the same person with $100,000 in taxable income, dividend income would provide a net after tax return of 74.6%—leaving significantly more money in their pocket compared to interest income as a result of the dividend tax credit.

- These percentage returns for a higher taxable income of $250,000 are less attractive—they decrease to 46.5% and 60.7%, respectively. However, even at the higher rate of income and taxes, the return from dividends amounts to about 30% more after tax than the return from interest income.

- Example #2: Capital Gains Income & Real Estate Investment Trusts (REITs)

- Capital Gains Income: Using the taxable income levels from Example #1, the after tax returns on capital gains are 78.3% and 73.2%, respectively.

- REITs: These investments also have some tax advantages, as a proportion of their distributions are taxed as regular income at the highest rate, but a portion, sometimes substantial, can be return of capital. This return of capital is tax deferred until the REIT investment is eventually sold and then taxed at the lower capital gains tax rate.

In conclusion, a retirement plan needs to account for the effects of inflation, and while interest bearing investments may be the norm in one’s retirement, REITs and dividend paying common shares, preferably dividend growth stocks, with their cash flow potential and tax effectiveness, can be a valuable strategy for a retirement portfolio. If these investments also have the added potential for capital growth, their attraction is further enhanced. It makes sense to select investments that provide for both income and growth, while also attracting less tax.

Cash Flow In Action: Dividend Paying Stocks

In this section, gain deeper insight into Bloom Investment Counsel’s investment methodology—dividend paying stocks and dividend growers, and how they can help to grow and maximize your cash flow stream.

Why Choose Dividend Stocks?

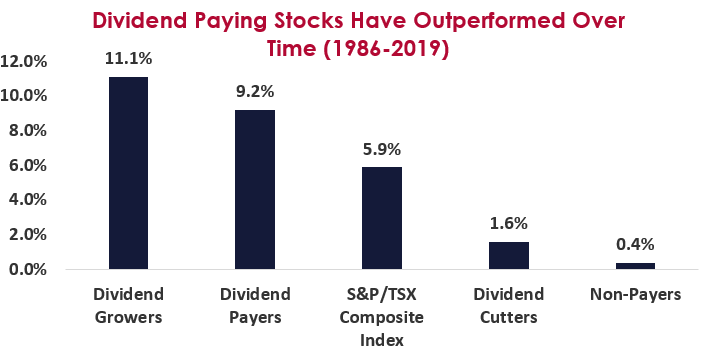

We know that dividend paying stocks are generally beneficial to your cash flow plan due to the steady stream of income generated from this investment vehicle and relatively low tax rates. It is also an important consideration that dividend paying stocks have outperformed the market at large over 33 years, with dividend growers and dividend payers seeing an average 10.2 percent increase, which is nearly twice the percentage increase of the S&P 500 (which had a mere 5.9 percent increase over the same time period).

Source: RBC Capital Markets Quantitative Research

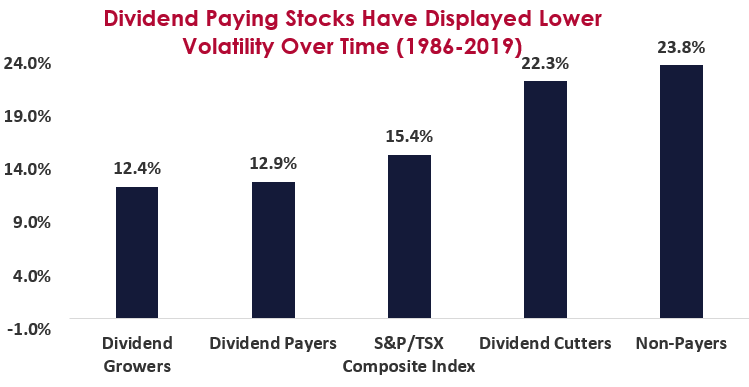

Not only do dividend paying stocks perform better, but they also have historically displayed lower volatility. Over the course of 33 years, dividend paying stocks have experienced approximately a 12 to 13 percent volatility ratio, while non-payers have seen a ratio that is nearly double that meaning their volatility is significantly greater than dividend payers.

Source: RBC Capital Markets Quantitative Research

Which Stocks Provide Solid Cash Flow?

While your comprehensive personal investment strategy must ultimately come from you, taking into consideration your preferred level of risk, your liquidity ratio, and your goals, below we’ve outlined some notable examples of assets that have historically provided healthy streams of income (Bloom has purchased these investments for clients in the past and may purchase them in the future. Please contact Bloom to find out if these investments are right for your portfolio).

1. ENB.TO

Enbridge Inc. is a good example of a company that has provided consistent dividend growth. Since its inception, it has had a wealth of dividend increases—26 consecutive increases, to be exact. This is a result of the longevity of its cash flows given its long term agreements. The power of dividends has enabled this stock to outperform over the past 20 years.

Source: Yahoo Finance

2. T.TO

Telus is a good example of a strong dividend payer and a company that dependably increases its dividend over time. Since 2004, the organization has returned approximately $19 billion to shareholders representing nearly $15 per share.

Source: Yahoo Finance

3. TD.TO

TD is a good example of a consistent and growing dividend payer. Its annual dividend has increased over six times in the past 20 years from $0.50 to the current rate of $3.16, which is a good illustration of a natural inflation hedge. This has enabled the stock to outperform the TSX by a wide margin.

Source: Yahoo Finance

The Bottom Line

Given that a large portion of the S&P/TSX Composite Index’s total return is from dividends, if you’re not capitalizing on dividend-paying stocks, you may be missing out. The increased flexibility from a steady stream of cash flow indicates you can afford to diversify and experiment with your other assets—providing more opportunities for expanding your wealth. We hope this guide has provided you with a deeper understanding of how to sustain a healthy cash flow throughout all phases of life, so that you can experience the joys of financial freedom.

This content is provided for general informational purposes only and does not constitute financial, investment, tax, legal or accounting advice nor does it constitute an offer or solicitation to buy or sell any securities referred to. Individual circumstances and current events are critical to sound investment planning; anyone wishing to act on this content should consult with his or her financial partner or advisor.