How Dividend Portfolios Can Preserve and Build Wealth, Even During Recessions and Bear Markets

Did you know that, over the long-term, consistent dividend-payers have realized higher returns with less risk than non-dividend paying stocks? In this article, you’ll learn how dividend portfolios can preserve and build wealth in the long term, even during recessions and bear markets.

Dividend Contribution to Long-Term Total Returns

Warren Buffet is considered by many to be the greatest investor of all time. His value investment style favors consistent high-dividend payments over multiple years, considering them a massive “green flag” for a company—signaling a sustainable, profitable business model with the potential to reward investors in the long run.

It therefore does not come as a surprise that a large portion of gains flowing into Warren Buffet’s Berkshire Hathaway portfolio can be attributed to dividend income.

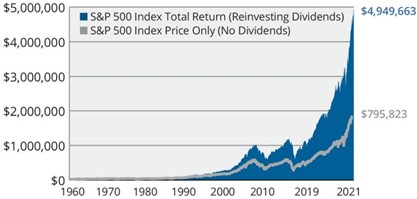

Looking at the U.S. equity market as represented by the S&P 500 Total Return Index, you can see that dividends have contributed significantly to the return investors have received. The chart below illustrates that $10,000 invested in the S&P 500 Index in 1960 would be worth just under $5 million in 2021, 61 years later. This is attributed to the reinvestment of dividends and the power of compounding.

The Power of Dividends and Compounding: Growth of $10,000 (1960-2021)

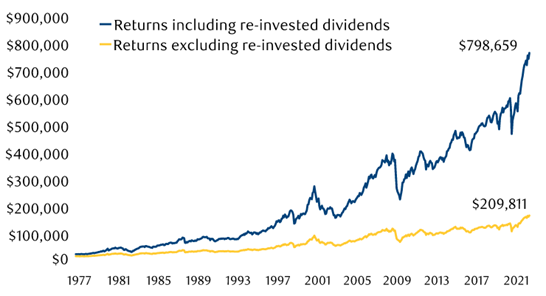

Similarly, looking at the Canadian equity market over a shorter period of time as represented by the S&P/TSX Composite Index, you can see that dividends have contributed significantly to the return investors have received. Investing $10,000 in 1977 would amount to just under $800,000 over the 44 years to the end of 2021 due to the reinvestment of dividends and the power of compounding.

The Power of Dividends and Compounding: Growth of $10,000 (1977-2021)

It is no coincidence, then, that having a dividend portfolio can be a solution to preserving and building wealth in the long term.

Dividend Portfolios in Recessions and Bear Markets

Recessions and bear markets are an unavoidable part of long-term investing. Market downturns and economic crises are largely unpredictable.

From the end of World War II to 2021 there have been eleven bear markets and recessions*. That being the case, studies support that “time in the market” still outperforms attempts to “time the market.”

Dividend payments during these periods were far less volatile than general stock prices. The average market decrease of the S&P 500 Index during these downturns was (-33.9%). The average decrease in dividend payments during the same time periods was (-0.5%).

*It should be noted that these periods include one outlier, the financial crisis of 2008-2009. The U.S. Federal Government issued bailout funds to most financial institutions whether they needed the bailout or not and, these institutions were pressured to substantially cut their dividends.

A well-diversified portfolio of dividend-paying stocks can lessen relative share price volatility while maintaining an income stream, regardless of economic conditions and overall equity market performance.

Historical and Timely (2022) Examples

Dividends During the Dot-Com Market Rise and the Tech-Bubble Burst

During the tech-bubble rise of the 1990s, investors clamoring for any stock related to tech or dot-com forsook fundamental investment basics along with any regard for dividend-payments.

Following the dot-com, tech-bubble burst in 2000 and the subsequent decade of negative equity market returns, many investors returned to stock market fundamentals and the relative stability of dividend income.

Through the dot-com market rise and the tech-bubble burst, dividend payments continued with negligible impact from dot-com driven market volatility.

Dividends During the Pandemic

In 2020, after the onset of the Covid-19 pandemic, 242 U.S. companies cut or suspended their dividends to preserve capital during the continued health and economic hardships that had no foreseeable end. This compares to a mere 90 and 98 companies that cut or suspended their dividends in 2008 and 2009, the previous significant period of dividend reductions.

As vaccines were developed and economies recovered through 2021, companies began to reinstate dividends and distribute record high excess cash.

For the calendar year 2021 U.S. company dividend payments totaled a record high as many companies reinstated their dividends and increased their dividend payment amounts. Many analysts are forecasting another strong dividend payout total for 2022.

Dividends in Today’s Market

During periods of inflationary pressure and rising interest rates, which typically result in lagging or negative stock market returns, dividend-payers can provide for more stable returns and lower volatility while benefitting from potential capital growth when the market recovers.

Key Takeaway

Dividend-paying portfolios are not a flavor-of-the-day investment strategy or an equity management style that comes in and out of favor relative to general equity markets because whether bear or bull, dividend investing is timeless.

Many investors discover the benefits of a dividend-paying portfolio strategy when they are looking for more stable equity investments during times of economic pressure and/or investment market uncertainty. And once they do commit, most maintain their dividend portfolio allocation for the long-term through all market cycles.

Bloom Investment Counsel And Long-Term Dividend Investing

For more than 37 years, through various market cycles, Bloom Investment Counsel, Inc. has specialized in providing actively managed, customized Canadian and U.S. dividend-paying portfolios for wealthy individuals, family offices, foundations, corporations, institutions, and trusts.

With customized dividend-paying portfolios, our clients’ portfolios earn income, in addition to participating in potential capital gains from an increase in value of the underlying stocks themselves. With dividend reinvestment these portfolios can participate in the historically strong total returns exhibited by dividend-paying stocks.

To perfectly time the market is virtually impossible. Invest long term. Get in touch with Bloom to learn more about our personalized investment management service.

This content is provided for general informational purposes only and does not constitute financial, investment, tax, legal or accounting advice nor does it constitute an offer or solicitation to buy or sell any securities referred to. Individual circumstances and current events are critical to sound investment planning; anyone wishing to act on this content should consult with his or her financial partner or advisor.