Dividend Investing in Different Market Cycles

Dividend-paying stocks have historically proven to be resilient to recessions and bear markets while potentially providing long-term superior total returns.

Not only have dividend-paying stocks proven their worth in tough markets, but they have also played a significant role in providing long-term returns through all phases of a market cycle. Dividend-paying stocks have generated consistent, positive income streams, regardless of general market cycles, and the long-term compounding benefits of reinvesting dividend payments have significantly added to total returns.

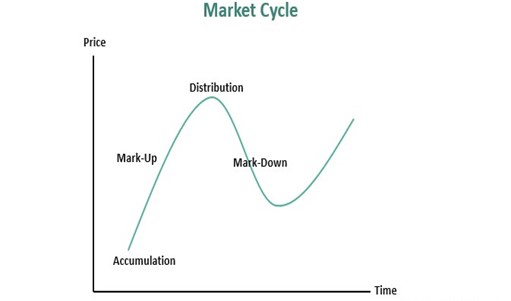

Understanding the Market Cycle

The market cycle for investing refers to the recurring pattern of ups and downs in financial markets. It is characterized by four distinct phases: accumulation, mark-up, distribution, and mark-down.

Accumulation: This stage begins when investors think that the market has “bottomed out” (reached the end of a trough) and the worst is over, i.e., a recession has ended and “expansion” begins. Economic prospects look good; stock prices are low and value is high.

Mark-Up: The market is more stable, and the volume of stock buying increases as economic expansion continues. The media typically hypes market growth in this phase, and the increased buying supports a ‘bull market”.

Distribution: Market growth starts to slow at the “peak” of corporate earnings growth and interest rates have typically bottomed out.

Mark-Down: Also known as downtrend and economic contraction. Investors try to lock in profits resulting in widespread selling. Economic growth slows, interest rates rise, and inflation begins to spiral upward. A prolonged mark-down becomes a “bear market”. When the economy bottoms out, the cycle has reached a trough. The mark-down period and trough will eventually end, and the market cycle will start over again. A typical market cycle lasts five to seven years.

Dividend Investing and the Market Cycle

Dividend-paying stocks tend to be less volatile than stocks that don’t pay dividends. Therefore, investors are more willing to keep these stocks through a recession and bear market. With dividend-paying stocks, the return comes from both share price increases and dividend payments providing a total return approach. Even if the share price falls you will most likely still receive the dividend payment.

As well, when the dividend stock price falls but it maintains its dividend, its dividend yield increases. Therefore, the stock becomes more attractive to investors. By purchasing dividend-paying stocks when prices are low, you can profit from a future price rebound and earn dividend income while you wait.

As dividends tend to fall less severely than share prices during a recession, this can be a great opportunity for investors to buy quality dividend-paying companies at much higher yields as well as lock in superior long-term returns.

Dividend-paying stocks are also a good hedge against inflation. High-quality companies can often raise the prices of the goods or services they provide in order to protect cash flows from inflation and possibly increase their dividends. This results in them being able to support payout ratios and dividend payments through various market cycles.

What to Look for in Quality Dividend-Payers

When looking for a high-quality dividend payer, here are a few key points, among others, you should keep an eye out for.

- Consistent earnings growth to support dividend growth for long-term total returns.

- Sustainable dividend payout that reduces volatility in share price movements.

- An emphasis on sustainable cash flow which supports a low probability of dividend cuts.

The Bottom Line

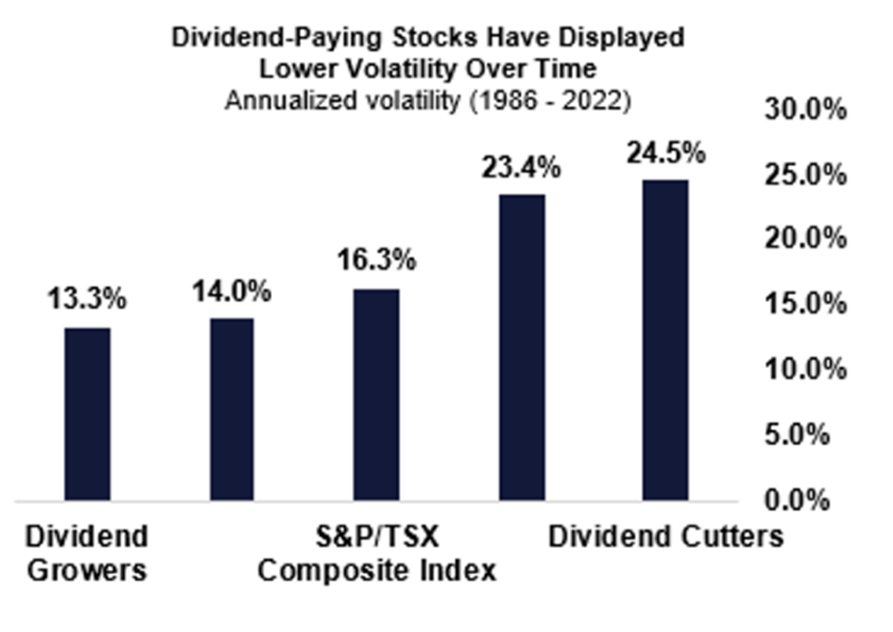

Over multiple market cycles, quality dividend-paying stocks have outperformed the market while displaying lower price volatility, thereby providing a core building block for long-term investing.

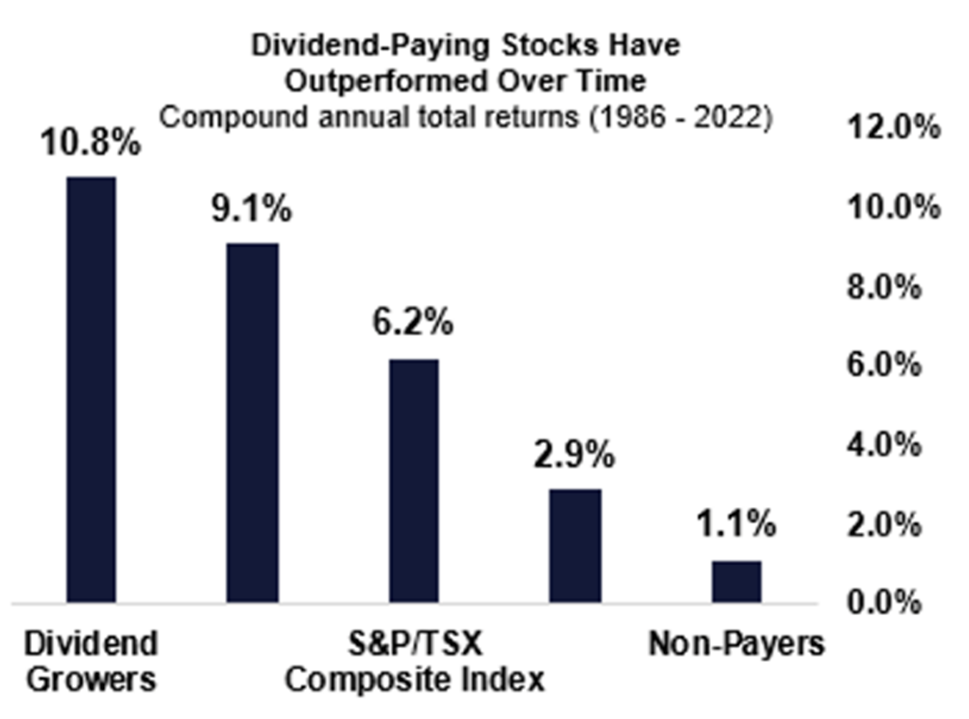

The consistent income generated by dividend-paying stocks has historically helped mitigate downside exposure during difficult markets, substantially boosted returns during strong market periods, and delivered superior total returns over full market cycles.

What to Look for in Quality Dividend-Payers

When looking for a high-quality dividend payer, here are a few key points, among others, you should keep an eye out for.

- Consistent earnings growth to support dividend growth for long-term total returns.

- Sustainable dividend payout that reduces volatility in share price movements.

- An emphasis on sustainable cash flow which supports a low probability of dividend cuts.

The Bottom Line

Over multiple market cycles, quality dividend-paying stocks have outperformed the market while displaying lower price volatility, thereby providing a core building block for long-term investing.

The consistent income generated by dividend-paying stocks has historically helped mitigate downside exposure during difficult markets, substantially boosted returns during strong market periods, and delivered superior total returns over full market cycles.

Dividend Investing With Bloom

Established in 1985, Bloom Investment Counsel, Inc. is a Toronto-based independent, privately-owned boutique investment management firm with experience in managing more than $2.5B in assets over the years.

We provide actively managed, customized Canadian and U.S. dividend-paying portfoliosfor wealthy individuals, family offices, foundations, corporations, institutions, and trusts.

For over 25 years, we have specialized in one thing and strive to be the best at it—investing in income-generating investments, specifically dividend-paying stocks, which can help you generate income, if needed, and growth from investing in the stock market.

Are you looking for a personal investment management service that can help you generate income, if needed, and growth? Let’s Talk. Call us at +1-416-861-9941 or email us at info@bloominvestmentcounsel.com

This content is provided for general informational purposes only and does not constitute financial, investment, tax, legal or accounting advice nor does it constitute an offer or solicitation to buy or sell any securities referred to. Individual circumstances and current events are critical to sound investment planning; anyone wishing to act on this content should consult with his or her financial partner or advisor.