6 Common Investment Misconceptions Explained

“An investment in knowledge pays the best interest. When it comes to investing, nothing will pay off more than educating yourself.” – Benjamin Franklin

We couldn’t agree more with Benjamin Franklin’s comment. What many perceive to be the reality about investing is often full of misconceptions.

Let’s review 6 common misconceptions about investing in the stock market—because your future will thank you for it.

Misconception #1

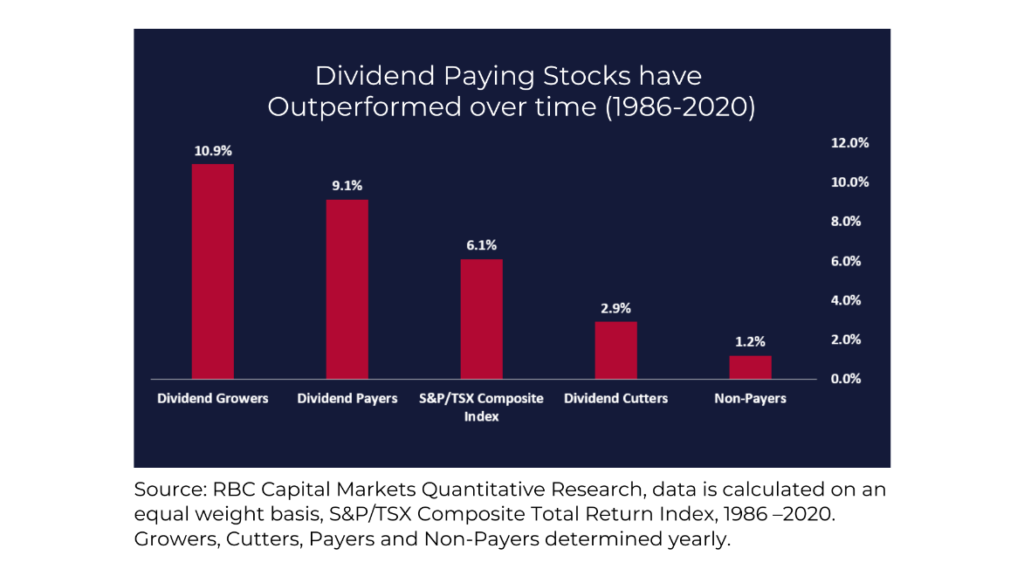

Dividend-paying equities do not perform as well as other equities.

Dividend-paying stocks may not be the most exciting option at first glance, but you may be missing out if you are not investing in dividend payers.

- Dividend-paying stocks provide you with two types of return—capital appreciation and regular income from dividend payments. Such independent and stable cash flow can add up over time, and can be reinvested, putting the magic of compounding to work.

- Investing in dividend-paying stocks means investing in solid, dependable companies that likely only initiate regular dividends when their management is fairly certain that they will be able to maintain these dividend payments for the foreseeable future.

- Dividends tend to increase over time, and can be (and often are) increased based on earnings that rise along with inflation. This means that dividend income will often keep up with inflation—or even exceed it.

There may be periods of time where dividend paying equities do not perform as well as the rest of the market; however, over the longer term, dividend paying equities have outperformed the broader market.

Misconception #2

Companies limit their growth by paying dividends, making them less exciting.

Dividend-paying stocks aren’t just for your grandparents.

Growth investors may argue that dividend payers would be better off reinvesting the cash to fuel growth instead of paying it out to investors.

Though dividend payers set corporate profits aside for dividend payouts, this does not mean that they are slow growers or any less exciting.

The best dividend stocks are from companies that increase their dividend payouts year after year—and again, don’t forget the power of compounding.

If that doesn’t sound exciting… remember, flashy one-time events may make you instantly rich, but not instantly wealthy (which happens when regular cash inflow outpaces regular cash outflow).

Further, a commitment to paying dividends requires management to act prudently on behalf of investors.

Management must maintain a high level of financial discipline to achieve company growth, while at the same time, produce enough cash flow for dividend distributions—the cherry on top of the cake.

Misconception #3

Having a long-term investment horizon is only for people who do not understand how the stock market works.

Investors who take a long-term approach display a prudent, disciplined and patient approach to investing—as they wait for higher returns down the road.

Many years of data indicate that investors are better off with a long-term investment horizon.

Holding stocks for the longer term tends to result in lower volatility and can provide capital gains tax advantages resulting in a higher return on your investment.

Misconception #4

Short-term investing produces the best results as an investment manager can quickly sell positions before they decline in value.

Theoretically, market timing may seem to make sense, but in the real world, it is nearly impossible for any investor to consistently time the market to buy and sell at the perfect moment.

Time is more important than timing in the market, and what happens in the short term is mostly inconsequential to the rational, long-term investor whose goal is to align his or her investment portfolio to meet long-term financial needs, objectives and/or legacy goals, preserving and growing wealth while providing downside protection—rather than chasing market levels.

Misconception #5

The stock market is always right, therefore following the Index (otherwise known as passive investing) produces the same or better investment returns than picking stocks based on fundamental analysis (active management).

Passive investing is the simplest, cheapest, and potentially cheaper way (due to its low-cost structure) to invest in the stock market, but what if the stock market drops?

By actively selecting investments based on fundamental analysis and valuation, professional investment managers are able to choose which stocks and sectors they believe a portfolio should have exposure to, as well as its respective position sizing, to provide downside protection from the overall stock market if the market drops.

Misconception #6

Utilizing low cost methods of investing such as Exchange Traded Funds (ETFs) provides the best returns.

There may be a place in your investment portfolio for low cost investment tools such as ETFs, but similar to Misconception #5, while ETFs have enjoyed a spectacular growth in popularity due to their low-cost nature, like all good things, they also have drawbacks—the most important of which is limited downside protection when the market drops.

Summary

If you are still in doubt over these 6 common stock market investing misconceptions, then it might be worth your time to dive deeper into the subject.

On a weekly basis, Bloom Investment Counsel, Inc. publishes free articles on the topics of investing, retirement, philanthropy, wealth planning, estate planning, life events, and financial literacy.

Preserve and Build Your Wealth with Investment Management

Investment management can be done independently, or through a professional investment manager who is committed to helping you and your family preserve and grow wealth without risking future security and legacy goals.

Bloom Investment Counsel is a well-established Toronto-based independent, privately-owned boutique investment management firm providing customized, actively managed, Canadian and U.S. dividend-paying portfolios for wealthy individuals, family offices, foundations, corporations, institutions and trusts.

The answers to you and your family’s most complex financial questions come when you connect with real people who care, not bots or algorithms. At Bloom, you and your family’s financial situation is private, personal and unique—and so is your investment portfolio. Visit Bloom’s website to learn more about our investment approach or get in touch with Bloom to find out what we can do to help you and your family protect and build wealth.

This content is provided for general informational purposes only and does not constitute financial, investment, tax, legal or accounting advice nor does it constitute an offer or solicitation to buy or sell any securities referred to. Individual circumstances and current events are critical to sound investment planning; anyone wishing to act on this content should consult with his or her financial partner or advisor.